If you’re like most Nigerians, you’ve probably heard more about real estate, crypto, or forex trading than Treasury Bills and Bonds. But here’s the truth: some of the smartest and wealthiest people quietly grow their money with government-backed securities. And in 2025, with rising interest rates, the opportunity is more attractive than ever.

This guide breaks down what Treasury Bills and Bonds are, how you can invest in them, and why now might be the best time to get in. No jargon. Just clear, actionable information.

What Are Treasury Bills and Bonds?

Treasury Bills (T-Bills) are short-term loans you give to the Nigerian government, and in return, they pay you back with interest after 91, 182, or 364 days.

Federal Government Bonds (FGN Bonds) are longer-term investments that can span from 2 years to as long as 30 years. The government pays you interest (called a coupon) every six months until maturity.

Why Most Nigerians Miss Out

- They assume it’s for the elite or corporate investors.

- They don’t understand how it works.

- They’ve never seen the numbers showing how much you can actually earn.

Let’s fix that.

Real Returns: T-Bill & Bond Rates Over the Years

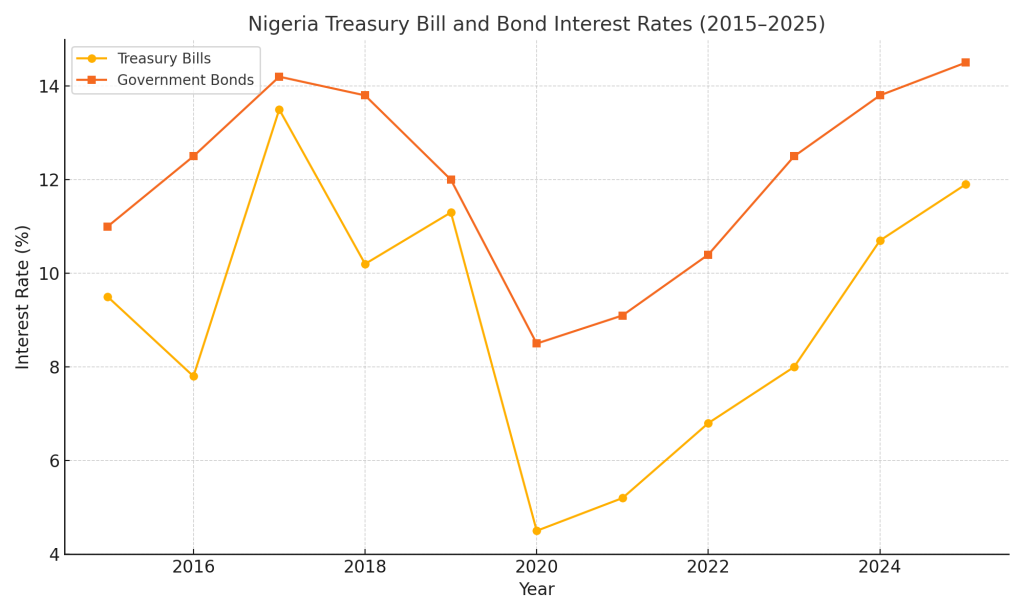

Nigeria has experienced inflation and currency devaluation, but Treasury yields have remained fairly competitive. Below is a visual chart of average yields from 2016 to 2025:

Key Highlights:

- 2017: T-bills peaked at over 18%

- 2020: COVID-19 impact led to sub-5% rates

- 2024–2025: Strong rebound to 13–15%

This kind of return is difficult to find with low risk anywhere else.

How to Invest in Treasury Bills and Bonds in Nigeria

Option 1: Through Banks

- Walk into major banks like GTBank, Zenith, and First Bank.

- Fill out an investment instruction form.

Option 2: Through Mobile Apps & Brokers

- Use trusted digital platforms like:

Option 3: Through CBN Direct Auction

- Visit cbn.gov.ng to track auction schedules.

- You can apply through your broker.

Which Should You Choose—T-Bills or Bonds?

| Feature | Treasury Bills | FGN Bonds |

|---|---|---|

| Investment Duration | 91, 182, 364 days | 2–30 years |

| Return Rate | Lower but faster | Higher over time |

| Liquidity | More flexible | Less liquid |

| Risk Level | Very low | Very low |

| Ideal For | Short-term planning | Long-term wealth building |

What’s the Minimum Investment?

- T-Bills: From ₦100,000

- FGN Bonds: Typically ₦50,000 and above

Pro Tip: Many platforms pool investors together so you can start small.

Hidden Benefits Nobody Talks About

- T-Bills are tax-free in Nigeria—you keep all your profits.

- You can use FGN Bonds as collateral for loans.

- Stable returns: perfect for retirement planning or school fees.

Smart Tips Before You Start

- Use a laddering strategy—spread your investments across multiple maturities.

- Reinvest your earnings to benefit from compounding.

- Track auction dates and don’t miss out.

- Confirm NAICOM or SEC registration when using brokers.

Final Thoughts: The Quiet Wealth Builder

Treasury Bills and Bonds won’t make headlines like crypto pumps, but they are proven, government-backed, and low-risk.

If you’ve been looking for a smart way to preserve and grow your money in Nigeria, this is it.

No stress, no guesswork—just real returns.

Start with what you have, even if it’s just ₦50,000, and build from there.

Want more no-fluff, clear financial insights? Subscribe to the Lands of Nigeria Blog for regular tips.