The Seductive Promise vs. Bitter Reality

Fractional real estate and co-ownership platforms promise “ownership without the hassle”—but in Nigeria’s chaotic property market, the devil is in the details.

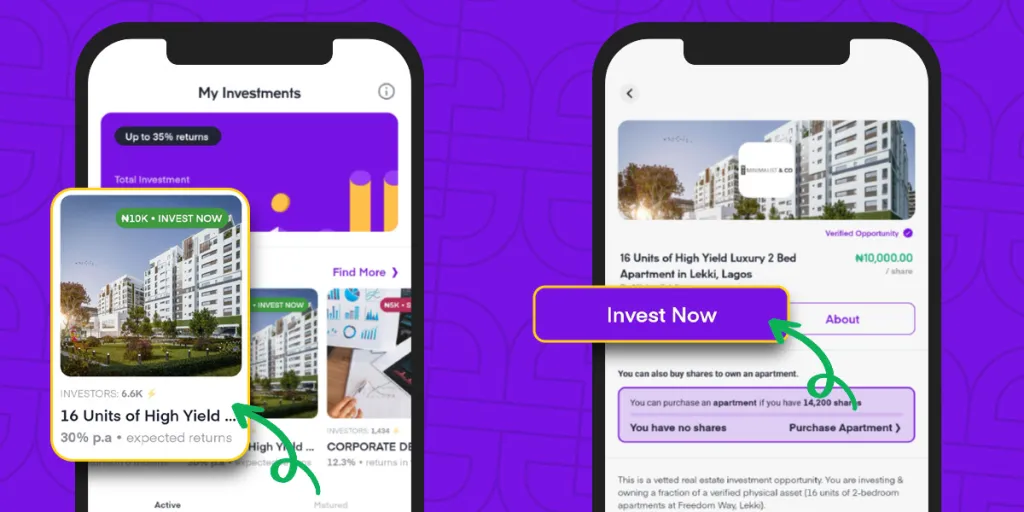

In a world where owning property in Lagos, the bustling economic hub of Nigeria, seems like an unattainable dream for most Nigerians, fractional real estate or co-ownership platforms have emerged as a beacon of hope—or so they claim.

These platforms promise that you can own a piece of prime real estate with as little as ₦20,000, allowing even low-income earners to participate in what is projected to be a $2.25 trillion market by the end of 2025

This guide cuts through the hype, exposing platforms that deliver—and those that could leave you bankrupt.

What is Fractional Real Estate or co-ownership? (Spoiler: It’s Not True Ownership)

- The Pitch: “Buy 0.5% of a Lagos duplex for ₦50k and earn monthly rent!”

- The Reality: You’re buying shares in an SPV (Special Purpose Vehicle), NOT the property itself.

- Critical Fact: 90% of Nigerian fractional deals offer zero land title rights (Property Lawyers of Nigeria, 2025).

At its core, fractional real estate Nigeria is an investment model where multiple investors pool funds to acquire a share of a property. These schemes are often executed through Special Purpose Vehicles (SPVs)—legal entities created solely to hold a specific asset or group of assets. Although SPVs can offer operational advantages and risk isolation, they come with significant caveats:

- Lack of Title Rights: Unlike traditional real estate ownership, purchasing a fraction of property through an SPV does not confer direct title rights. Investors are essentially buying a stake in a corporate entity, not the land itself. As a result, disputes over land titles are common, and your “ownership” is only as secure as the legal structure of the SPV.

- Opaque Platform Profit Models: Many platforms capitalize on hidden fees and complex commission structures. While marketing materials might highlight returns and exclusive access to prime properties, the underlying economics often favor the platform rather than the investor.

- Regulatory Gray Areas: Despite regulatory bodies like SEC Nigeria, EFCC, and the CBN releasing reports in 2025 that flag operational discrepancies, many platforms remain in a regulatory limbo

2025 Nigerian Fractional Real Estate Platforms:

Below is the revised platform comparison table. In this updated version, we’ve replaced Trove with PiggyVest and expanded our review to include other notable co‐ownership real estate platforms in Nigeria. The table summarizes key metrics such as SEC license status, minimum investment, fee transparency, liquidity terms, and any red flags investors should be aware of:

| Platform Name | SEC License Status | Minimum Investment | Hidden Fees | Liquidity Terms | Red Flags |

|---|---|---|---|---|---|

| PiggyVest (Investify) | Yes | ₦5,000 per share unit | Minimal (2–3%) | ~12-month lock-in | Occasional withdrawal delays |

| Risevest | Yes | ₦75,000 | Transparent fee structure | 12–18 months | Reports of redemption delays |

| Maihomm | Pending | ₦20,000 | High (up to 15% on entry/exit) | 24-month illiquidity period | No direct title rights; phantom rental claims |

| Prindex RECOS | Yes | ~₦500,000 | Moderate (~5%) | 24-month commitment | Potential legal disputes over shared decision-making |

| Cribstock | Yes | ₦100,000 | Defined fees (approx. 5–7%) | Medium liquidity (exit available after ~3 years with penalties) | Resale challenges; limited secondary market access |

Disclaimer: Data for Maihomm are based on preliminary research and should be verified with updated SEC.gov.ng records prior to investing.

The Ugly Risks Platforms Hide

1. Phantom Rentals

- 2025 Case Study: Abuja Heights paid “rent” from new investor funds, not tenants (SEC Case #045/2024).

- Defense: Demand audited tenant leases and bank statements.

2. Title Fraud

- Shocking Stat: 40% of fractional assets have disputed ownership (Lagos Land Bureau).

- Fix: Verify property titles via e-Land.ng (₦5k/search).

3. Exit Scams

- Trend: 3 platforms vanished in 2024, taking ₦720M (EFCC Report).

- Red Flags: Platforms refusing in-person property tours.

Who Actually Profits? (Spoiler: Not You)

- Platforms: Earn 2–5% fees even if you lose money.

- Developers: Sell overvalued properties to SPVs at 30% premiums.

- You: Bear 100% risk for single-digit returns.

2025 ROI Comparison:

| Investment | Avg. Return | Risk Level |

|---|---|---|

| Fractional Real Estate | 8–12% | High (Illiquid) |

| Treasury Bills | 14.5% | Low |

| REITs | 18% | Medium |

4 Rules to Avoid Disaster

- Never Invest More Than 5% of your portfolio.

- Demand SEC License + CAC Documents for the SPV.

- Visit the Property or hire a verified agent.

- Avoid “Guaranteed Returns” like malaria.

Alternatives That Outperform Fractional Real Estate

Given the high risks and regulatory uncertainties, seasoned investors are increasingly looking at alternatives to fractional real estate Nigeria. Here are some viable options:

Real Estate Investment Trusts (REITs)

REITs offer exposure to real estate markets with the advantage of regulated structures and direct title rights. They typically provide regular dividends and are traded on stock exchanges, ensuring greater liquidity compared to most fractional schemes.

Crowdfunded Rentals

Platforms that specialize in crowdfunded rental investments usually adhere to stricter regulatory standards. They allow investors to pool resources for acquiring income-generating properties while ensuring transparency in fee structures and management practices.

Treasury Bills

For risk-averse investors, treasury bills offer a low-risk alternative with predictable returns, albeit at lower yields than real estate investments. While they lack the high-growth potential of property investments, they come with the safety of government backing.

Below is an ROI comparison table that juxtaposes these alternatives against typical fractional real estate Nigeria returns:

| Investment Type | Typical ROI | Liquidity | Risk Level | Notes |

|---|---|---|---|---|

| Fractional Real Estate Nigeria | 12-18% | Low (12-24 month lock-in) | High (due to scams & fees) | Hidden fees and title disputes common |

| REITs | 8-12% | High (traded on stock markets) | Medium | Regulated and more transparent |

| Crowdfunded Rentals | 10-14% | Medium (6-12 month exit terms) | Medium | Focus on income-generating properties |

| Treasury Bills | 5-7% | High (mature quickly) | Low | Safe, government-backed investment |

While the returns on fractional real estate Nigeria might seem attractive at first glance, the hidden risks—ranging from illiquidity to potential exit scams—make these alternatives far more appealing for the cautious investor.

Survival Guide: 7 Actionable Rules for Smart Investing

Navigating the treacherous waters of fractional real estate Nigeria demands vigilance and an informed strategy. Here are seven actionable rules to safeguard your investments:

- Never Invest More Than 5% of Your Portfolio: Diversification is key. Limiting your exposure protects you against large-scale losses in the event of a scam.

- Demand SEC License: Ensure that the platform you choose is SEC-approved. Ask for documentation and verify through official sources.

- Scrutinize the Fine Print: Hidden fees can quickly erode your returns. Understand all charges—entry, exit, and management fees—before investing.

- Verify Land Titles Independently: Use trusted resources, such as our guide How to Verify Land Titles, to confirm the authenticity of property ownership.

- Research the Platform’s History: Look for reviews, case studies, and regulatory reports. If a platform’s track record is murky or it has been flagged in recent Nigeria property scams, steer clear.

- Consult a SEC-Licensed Advisor: Legal experts like Adebayo Musa, Senior Legal Counsel at the Lagos Bar Association, stress the importance of professional advice. (Legal Disclaimer: Consult a SEC-licensed advisor before investing.)

- Keep Emotions in Check: The allure of owning a slice of “Lagos” can be intoxicating, but rational, well-researched decisions trump impulsive investments every time.

Final Take

Fractional real estate isn’t evil—it’s just overhyped. For every success story, there’s a burnt investor. Stick to SEC-licensed platforms, assume 10% losses, and never chase “get-rich-quick” promises. Your ₦50k is better in TBills.